My Investment Manifesto

Thoughts on investing and wealth

by Henrik Jernevad

This document summarizes what I have learned after reading quite a lot about investing and wealth, and the conclusions I have made.

While I wrote it for my own sake, and it is based on my ideals and my economy, it can hopefully be of value to others as well. However, keep in mind that I am no trained economist. I promise nothing. I'm not saying this is the only way (or even a good one), just the one I have chosen.

Also, note that some quotes are in Swedish. Translate or ignore them, as you wish.

Best Regards

Henrik Jernevad, 2013-07-30

Mindset

Most people do not become wealthy. To a large degree, this is because it never occurs to them or they never really decide to. I have decided to become wealthy.

The question then is why do I want to be wealthy?

Wealth just doesn't bring joy. Beyond the levels necessary to survive, and live comfortably wealth is not directly correlated to happiness. In fact, researchers at Princeton studied just that. While the "comfort level" was dependent on the survey respondent's location, when it all shook out, it turns out that beyond about $75,000 we just don't find much more happiness.

Jesse Mecham, You Need A Budget

My goal is to get a passive income which enables me to focus on what I want to do, rather than what I have to do. I could retire early if I wanted to, I could help my future children, or I could go on vacation more often.

Knowing that I want to become wealthy and why, I need to figure out how.

Understand that wealthy people, by definition, are investors. There are no exceptions to that rule. If you want to be wealthy, you need to be investing.

Jesse Mecham, You Need A Budget

I will invest money in order to increase my wealth. Instead of using that money today, I realize that by delaying gratification the sum of the whole becomes bigger.

The purpose of a budget is to […] enable thee to realize thy most cherished desires by defending them from thy casual wishes.

George S. Clason, The Richest Man in Babylon

I will continuously educate myself regarding investment in order to reach my goals.

[One of the remedies] for a lean purse is to cultivate thy own powers, to study and become wiser, to become more skillful, to so act as to respect thyself. Thereby shalt thou acquire confidence in thy self to achieve thy carefully considered desires.

George S. Clason, The Richest Man in Babylon

However, I do not want to spend much time on investing, because I'm not very interested in it, nor economy in general.

Components of investing

There are three components that decide how effective my investing is going to be: the amount I invest, the time the money will be invested, and the growth of the investment.

As for the amount I invest, it is determined by “the gap” – the difference between what I earn and what I spend.

I will invest as much money as I can…

[Save] whatever portion seems wise. Let it be not less than one-tenth and lay it by. Arrange your other expenditures to do this if necessary. But lay by that portion first. Soon you will realize what a rich feeling it is to own a treasure upon which you alone have claim.

George S. Clason, The Richest Man in Babylon

...while still living comfortable and in alignment with my values.

Enjoy life while you are here. Do not overstrain or try to save too much. If one-tenth of all you earn is as much as you can comfortably keep, be content to keep this portion. Live otherwise according to your income and let not yourself get niggardly and afraid to spend. Life is good and life is rich with things worthwhile and things to enjoy.

George S. Clason, The Richest Man in Babylon

Because of compound interest, growth of an investment is also massively affected by the time it is given. Because time is something I never get back, I will start investing now and keep it up continuously.

To show the power of compound interest, imagine if you save a dollar every month at a 10% annual rate. Then you would have doubled your money in 13 years, trippled it in 20 years, quadrupled it in 25 years, and you have ten(!) times your money in 38 years.

Henrik Jernevad (me)

The rate of return on an investment is built up by a number of factors. Of these, only one is positive: growth. The rest are all negative: taxes, inflation, transaction fees, and investing fees.

I will try to maximize the growth of my investment and minimize the negative factors of return rate that are within my power to change.

I also realize that taxes are my life's single biggest expense. I will not take them lightly.

Not trying to time the market

When investing, I will focus on the factors that I can control.

I realize that I cannot predict or influence the market and will not waste my time trying.

The Dow Jones average started the 20th century at 66. It ended at 11 400. You say; how could you lose money in a period like that? A lot of people did because they tried to dance in and out.

[Under perioden 2008 till 2012 har Avanzas kunder investerat] med en betryggande underavkastning. [Alltså hade] Avanzas kunder som kollektiv gjort sig själva en stor tjänst genom att placera sina pengar i Avanza Zero som skuggar SIXRX.

No matter what the state of the mutual fund industry, boom or bust: [...] Mutual fund investors who hold on to their investment are more successful than those who time the market.

The QAIB Report, through Jan Bolmesson, RikaTillsammans.se

I accept that I am not more likely than anyone else on the market to know whether a stock is going up or down, and that believing so would be an illusion.

Most of the buyers and sellers know that they have the same information; they exchange the stocks primarily because they have different opinions. […] The puzzle is why buyers and sellers alike think that the current price is wrong. What makes them believe they know more about what the price should be than the market does? For most of them, that belief is an illusion.

Daniel Kahneman, Thinking, Fast and Slow

[Most winners on the stock market] were just lucky.

I realize that even fundamental analysis fails to predict the movement of a stock.

Unfortunately, skill in evaluating the business prospects of a firm is not sufficient for successful stock trading, where the key question is whether the information about the firm is already incorporated in the price of its stock. Traders apparently lack the skill to answer this crucial question, but they appear to be ignorant of their ignorance.

Daniel Kahneman, Thinking, Fast and Slow

Since I do not try to time the market, I do not gain from listening to financial news or advisors.

Instead, I will focus on asset allocation as my primary investment strategy.

Since you cannot successfully time the market or select individual stocks, asset allocation should be the major focus of your investment strategy, because it is the only factor affecting your investment risk and return that you can control.

William Bernstein, The Four Pillars of Investing

My allocation strategy

I will invest based on known facts and things that I can control, not uncertain forecasts or guesses of the future.

I will have a diversified investment portfolio in order spread the risk.

Att spara pengar i aktier påminner mycket om det vi ser på en fotbollsplan. Det behövs målvakt, försvarare, mittfält och anfall.

I will choose investments with as low fees as possible.

Mellan tummen och pekfingret kan man säga att för varje 0.25 % som du kan sänka dina avgifter, så kommer du nå dina mål ett år tidigare.

I will use index funds or global funds as my primary investment type, because of their good diversity and low fees.

The best way to own common stocks is through an index fund.

[You] are better of just buying passive index funds that charge very low fees.

I will use bond funds in order to make my portfolio more conservative.

Bonds are less risky than stocks, and there are good reasons why: If a company goes belly up and has to liquidate, bondholders would be paid before stockholders. Stockholders get what's left. Bonds are paid interest before stockholders are paid any dividends (the company is obligated to pay the interest, they are not obligated to pay a dividend).

Jesse Mecham, You Need A Budget

However, knowing that bonds are more advantageous when interest rates goes down, I will prefer longer term bonds when interest rates are high, and shorter term bonds or cash when they low.

The biggest economic threat to bonds is rising interest rates. If you own a bond and interest rates go up, the value of your bond on the open market, with few exceptions, will go down.

While I will not try to predict all the short-term ups and downs of the stock market, I will invest with the business cycle to avoid the big (multi-year) stock market down periods. During these periods I will use cash or bonds to maintain the value.

Note: I realize that this means basing investment on a prediction of the future (which I try not to), but feel the link has been solid enough historically for me to trust it.

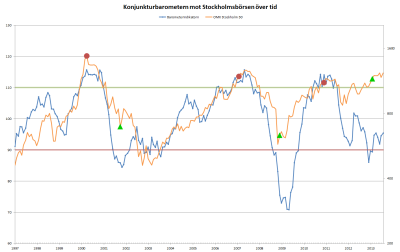

[Idén är] att man går ur börsmarknaden när barometerindikatorn legat över 110 i tre månader. [...] Sedan köper man in sig på börsen igen när barometerindikatorn legat under 90 i tre månader [...].

Den som bara suttit still i börsindex har sedan 1996 fått en avkastning på 146%, eller ca 5.4% om året.

Om man istället enligt konjunkturbarometern hoppat över till obligationer eller tillbaka till börsen igen har man sedan 1996 fått 1103% i avkastning, eller 15.2% om året. En enorm skillnad, förstås som visar hur viktigt det är att sälja runt konjunkturtoppen och köpa vid konjunkturbotten.

The analysis is based on the Swedish Konjunkturbarometern (Economic Tendency Survey) and the OMXS30 stock index over a sixteen year period (1997-2013).

I will continuously reallocate to maintain my target ratio between different types of investments.

På lång sikt är det svårt att slå 60/40-strategin. (Andra proportioner fungerar också, huvudsaken är att man är konsekvent.)

Det som är bra med 60/40-styrategin är att man tvingas köpa den aktiva klassen som går dåligt på marknaden. När aktier faller så tvingas man köpa mer aktier, och tvärtom. De allra flesta som sparar, inte bara du och jag, men även stora institutioner, gör misstaget att köpa aktier när de håller på att bli för dyra och följa flocken när de börjar bli billiga. När man följer 60/40-strategin tvingas man hela tiden återställa balansen.

Based on your risk preference and time horizon, you decide you need to be 50% invested in stocks, and 50% invested in bonds. Let's say that portfolio is $20,000 where $10,000 is in stocks and $10,000 in bonds.

Then stocks go on a tear! They're up 30% on the year. Bonds, meanwhile have taken a 10% dip. Your overall portfolio is up 20% on the year, valued at $22,000 and you're feeling really good about things.

However, your mix is now off. [...] So you sell $2,000 of your stocks, and purchase $2,000 of bonds. You've now sold stocks when they were high, and bought bonds when they were low. It's very true that stocks may still continue to rise, and bonds may continue to fall, but as you hold your ground on this principle over the long haul, and as long as the market rises over the long-term, you will end up buying low, and selling high. Its fancy name is dollar-cost averaging.

Jesse Mecham, You Need A Budget

Practical considerations

I will pay myself first by moving money into my investment account before using money for anything else.

A part of all you earn is yours to keep. It should be not less than a tenth no matter how little you earn. It can be as much more as you can afford. Pay yourself first.

George S. Clason, The Richest Man in Babylon

I will make my investing as painless as possible by automating monthly transfers and the buying of relevant funds, bonds or stocks.

The key to winning the investment game is to be BORING. Set it and forget it. Impress people with how many pushups you can do, not with your stock-picking prowess.

Jesse Mecham, You Need A Budget

I will monitor the progress of my investments at most once a month, to avoid getting loss averse.

Closely following daily fluctuations is a losing proposition, because the pain of frequent small losses exceeds the pleasure of the equally frequent small gains. Once a quarter is enough, and may be more than enough for individual investors. […]

A commitment not to change one's position for several periods improves financial performance.

Daniel Kahneman, Thinking, Fast and Slow

I am in it for the long haul, wanting a small piece of the returns generated by the global stock market over time.

Under den period Riksbanken har statistik för (1919 till 2006) fanns ingen 10-årsperiod där Stockholms-börsens avkastning var negativ. Under en genomsnittlig 10-årsperiod inom detta intervall ökade pengarna med 366% vilket motsvarar en årlig avkastning på knappt 14%. Den totala avkastningen under hela tidsperioden motsvarar en årlig avkastning på drygt 11%. Hänsyn är inte tagen till inflation.

Henrik Jernevad (me), based on statistics from The Riksbank (Sweden's central bank)

Resources and tools

= only available in Sweden

= only available in Sweden

You Need A Budget (software)

I use YNAB to budget, register all my transactions, keep track of my accounts, and generally make sure my economy stays in shape.

Avanza  (online stock broker)

(online stock broker)

I use Avanza to buy funds, and appreciate their modern interface, low fees, and the Avanza Zero index fund which has no fees what so ever.

HoistSpar  (savings accounts)

(savings accounts)

I use HoistSpar as my main savings account because of a mix of good interest rates and government-backed accounts.

The Richest Man in Babylon (book)

Teaches sound economic principles in the form of stories about the historic city Babylon.

Cornucopia?  (blog)

(blog)

Sweden's best blog on finance, economy, environment, and politics. Very educational!

Thinking, Fast and Slow (book)

Everything you've ever wanted to know about the human mind – and then some!

The Four Pillars of Investing (book)

How to assemble an investment portfolio with diversification and low expenses.

Note: If you buy things using the links above, I get a tiny bit of money.